Making millions as a professional athlete seems like a guaranteed ticket to lifelong financial security. Yet some of the world’s most famous sports stars have managed to lose every penny they earned, proving that talent on the field doesn’t always translate to smart money management. These cautionary tales show how quickly fortunes can disappear through poor decisions, bad investments, and reckless spending habits.

Leon Spinks went from heavyweight champion to broke

Beating Muhammad Ali for the heavyweight boxing title should have set Leon Spinks up for life with endorsement deals and lucrative fight contracts. Instead, addiction issues and poor financial planning caused his money to disappear almost as quickly as he earned it. The boxing legend struggled with substance abuse problems that derailed his career and drained his bank account through rehabilitation costs and lost opportunities.

After his boxing career ended, Spinks worked low-paying jobs to make ends meet while mounting medical bills piled up. By his later years, he relied heavily on Social Security payments and donations from generous fans who remembered his glory days. His story demonstrates how addiction can destroy not just careers but entire fortunes, leaving even world champions struggling to afford basic necessities.

Rollie Fingers lost millions on pistachio farms

Baseball Hall of Famer Rollie Fingers thought his iconic mustache and stellar pitching career would be followed by business success. Unfortunately, his post-baseball investment strategy proved disastrous when he poured his fortune into failed ventures. The most notable disasters were pistachio farming operations and Arabian horse breeding, both of which collapsed spectacularly and left him facing bankruptcy.

Despite earning millions during his Major League Baseball career, Fingers watched his business ventures crumble one after another. The aggressive investment approach that might work for some entrepreneurs proved catastrophic for the former closer. His financial downfall serves as a reminder that athletic success doesn’t guarantee business acumen, and even seemingly safe agricultural investments can turn into money pits.

Sheryl Swoopes filed bankruptcy despite Nike endorsements

WNBA superstar Sheryl Swoopes dominated women’s basketball and even had her own signature shoe line with Nike. The Nike Air Swoopes made her the first female athlete to have a signature basketball shoe, bringing in substantial endorsement money on top of her playing salary. However, poor investment choices and failed business ventures slowly drained away her wealth despite her groundbreaking success on and off the court.

By 2004, financial mismanagement had forced Swoopes to file for bankruptcy, shocking fans who saw her as the face of women’s professional basketball. Her case highlights how even athletes with diverse income streams from playing contracts and endorsements can lose everything through bad financial decisions. The bankruptcy filing marked a dramatic fall for someone who had broken barriers and earned millions throughout her pioneering career.

Johnny Unitas lost everything to failed circuit boards

Every modern NFL quarterback owes something to Johnny Unitas, whose innovative playing style revolutionized the position. Unfortunately, his football genius didn’t extend to business ventures, particularly a disastrous circuit board company that consumed his savings. The failed electronics business venture left one of football’s greatest players drowning in debt despite his legendary status and Hall of Fame career.

Medical expenses compounded Unitas’s financial troubles as his health declined in later years. The combination of business failures and mounting medical bills created an insurmountable financial burden. By the time he passed away, the quarterback who had defined excellence in football had little left to show for his remarkable career, proving that even legends aren’t immune to financial ruin.

Dorothy Hamill’s Ice Capades purchase backfired completely

America’s sweetheart on ice thought purchasing the famous Ice Capades would be a smart business move that capitalized on her Olympic fame. The figure skating champion believed her star power and understanding of the sport would translate into business success. Instead, the entertainment company quickly became a financial disaster that consumed her Olympic earnings and endorsement money.

When the Ice Capades went bankrupt, it took Dorothy Hamill’s personal fortune down with it. Her extravagant spending habits during her peak earning years had already strained her finances, but the failed business venture delivered the final blow. While her Olympic gold medal remained priceless, her bank account was completely empty, forcing her to rebuild from scratch after one massive investment mistake.

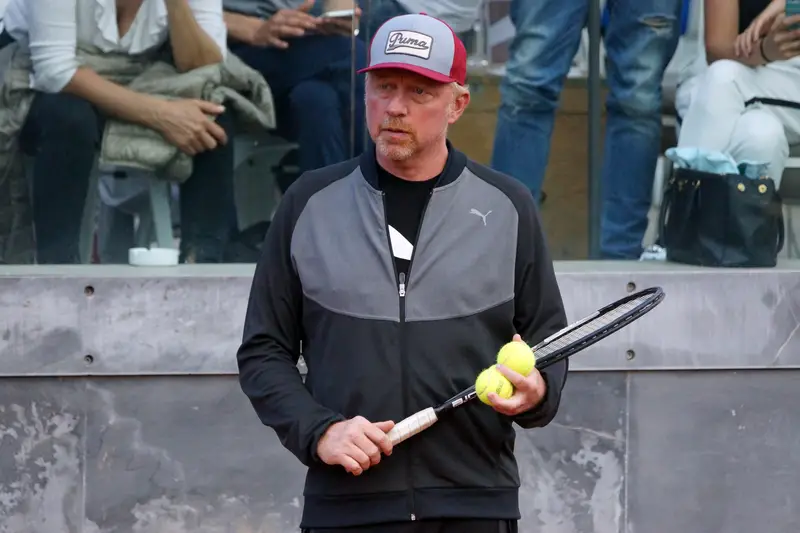

Boris Becker went from Wimbledon champion to prison

Winning Wimbledon at age 17 made Boris Becker tennis royalty with endorsement deals and prize money flowing in throughout his career. However, poor financial management and a high-profile tax evasion case eventually led to bankruptcy. His costly divorce proceedings further drained his resources, turning the former tennis champion into a cautionary tale about financial responsibility.

The situation deteriorated so badly that Becker ended up behind bars in 2022 for hiding assets during his bankruptcy proceedings. His case became international news as fans watched a former sports hero face criminal charges for financial crimes. A UK judge finally terminated his bankruptcy case in 2024, but the damage to both his reputation and financial security had already been done.

Allen Iverson couldn’t afford a cheeseburger at his lowest

Allen Iverson was once the face of the NBA with a $200 million fortune built from playing contracts and endorsement deals. His lifetime contract with Reebok alone should have provided financial security for decades. However, bad financial decisions, a costly divorce, and an extremely lavish lifestyle drained his wealth at an alarming rate, leaving him struggling to pay even basic expenses.

At his lowest point, reports claimed Iverson couldn’t afford to buy a cheeseburger, a shocking fall for someone who once commanded eight-figure contracts. Fortunately, a trust fund from his Reebok deal eventually provided some financial stability, but his downfall served as a harsh lesson about the dangers of excessive spending. His story shows how even athletes with seemingly bulletproof financial arrangements can end up broke through poor money management.

Dennis Rodman’s party lifestyle cost him everything

Few NBA players lived as extravagantly as Dennis Rodman, whose outrageous lifestyle made him a pop culture icon beyond basketball. His over-the-top spending habits, legal fees, and unpaid child support obligations slowly drained the millions he earned during his championship runs with the Chicago Bulls. The colorful hair, wild parties, and celebrity relationships came with a price tag that eventually exceeded his basketball earnings.

Poor money management turned the larger-than-life basketball star into someone struggling to stay financially afloat. Legal troubles and mounting debts replaced championship celebrations, transforming Rodman from a wealthy athlete into a cautionary tale. His financial struggles continue to this day, proving that even the most memorable personalities in sports aren’t immune to the consequences of reckless financial planning.

Antoine Walker lost over $100 million to gambling and spending

Antoine Walker earned over $100 million during his NBA career, but keeping that fortune proved impossible due to his spending habits and gambling addiction. Reckless purchases of luxury items, combined with significant gambling losses, steadily eroded his massive earnings. His financial troubles were compounded by an expensive divorce that further depleted his remaining assets.

By 2010, Walker had no choice but to file for bankruptcy and start rebuilding his life from scratch. The former NBA All-Star had to confront the reality that earning $100 million means nothing if spending exceeds income. His story has become a teaching tool for current athletes about the importance of financial discipline and the dangers of gambling addiction in professional sports.

These athletes’ stories serve as powerful reminders that earning millions doesn’t guarantee financial security. Poor investment choices, excessive spending, legal troubles, and addiction can quickly drain even the largest fortunes. Their experiences highlight why financial literacy and smart money management are just as crucial as athletic talent for long-term success after sports careers end.