The next time you pay a bill, take a close look at the fine print. Hidden fees are becoming increasingly common across industries, costing Americans over $64 billion annually. From restaurants to hotels, businesses are quietly adding service charges that can boost your total bill by up to 20%. Understanding these sneaky fees and knowing how to spot them can help protect your wallet from unnecessary expenses.

Why businesses are adding more service fees now

The practice of adding hidden charges, known as “drip pricing,” has become increasingly prevalent across various industries. Businesses claim these additional fees are necessary to offset rising operational costs, including increased labor expenses and inflation. However, instead of simply raising their base prices, many companies choose to maintain lower advertised prices while adding various surcharges at checkout.

This trend has caught the attention of government officials and consumer advocacy groups. The Biden administration has proposed legislation called the Junk Fee Prevention Act, which aims to require businesses to display the full price, including all mandatory fees, upfront. Several states, including California, New York, and Minnesota, have already passed laws requiring price transparency and banning hidden fees.

Despite these regulatory efforts, many businesses continue to add service charges to receipts. These fees often appear under various names like “kitchen fee,” “living wage fee,” or “wellness charge.” While some of these charges may support legitimate business costs, the lack of transparency can make it difficult for consumers to understand what they’re actually paying for.

The impact on consumers extends beyond just the financial burden. Hidden fees make it challenging to compare prices accurately between different businesses, potentially leading to market inefficiencies and reduced competition. This practice can also damage trust between businesses and their customers when people feel misled about the true cost of goods and services.

Common service fees found on restaurant receipts

Restaurants have become particularly notorious for adding various service charges to bills. One of the most common additions is the credit card processing fee, which typically ranges from 2% to 4% of the total bill. Some establishments also include a “kitchen fee” or “back-of-house fee” meant to support non-tipped staff members.

Another increasingly common charge is the “wellness fee” or “healthcare surcharge,” which businesses claim helps cover employee health insurance costs. These fees usually appear as a percentage of the bill, often around 3-5%. Some restaurants have also begun adding labor surcharges to offset minimum wage increases.

Service charges, which differ from voluntary tips, are also becoming more prevalent. Unlike tips, these mandatory charges are controlled by the restaurant and may not be distributed directly to servers. Some establishments add these charges automatically for larger parties but have begun extending them to smaller groups as well.

Technology fees represent another category of charges appearing on restaurant bills. These fees supposedly cover the cost of payment processing systems, online ordering platforms, or reservation systems. While these technologies do represent real business expenses, the separate fee structure can make it difficult for customers to understand the true cost of their meal.

Hidden fees in travel and hospitality services

The travel industry has mastered the art of hidden fees, with hotels and airlines leading the charge. Resort fees and destination fees can add significant costs to hotel stays, sometimes increasing the daily rate by $50 or more. These charges often cover amenities that guests might never use, such as pool access or gym facilities.

Airlines have developed numerous additional charges beyond the base ticket price. From seat selection fees to boarding pass printing charges, these costs can substantially increase the final price of air travel. Some carriers even charge for carry-on bags or selecting seats together for families.

Rental car companies often add daily charges for toll transponders, whether you use them or not. These fees typically range from $5 to $15 per day, plus the actual toll charges. Some companies also include various insurance fees, fuel surcharges, or additional driver fees that may not be clearly disclosed during the booking process.

Even rideshare services and food delivery apps have joined the trend, adding fuel surcharges, service fees, and various other costs that can significantly increase the final price. These fees often appear separately from the base fare or food cost, making it harder for consumers to understand the total expense upfront.

Banking and financial service hidden charges

Financial institutions are particularly adept at implementing various fees that can quickly drain your account. Monthly maintenance fees, ATM charges, and overdraft fees represent just a few of the common charges that banks impose on their customers. These fees can accumulate rapidly, especially for those who maintain lower account balances.

Credit card companies often include processing fees, late payment charges, and foreign transaction fees. Some cards also charge annual fees that may not be clearly disclosed during the application process. Additionally, many credit card issuers have complex fee structures for balance transfers or cash advances.

Peer-to-peer payment apps have introduced their own set of fees, particularly for instant transfers or business transactions. While basic transfers between friends might be free, using these services for business purposes or requesting expedited transfers often incurs additional charges that users might not expect.

Investment accounts and retirement funds can also harbor hidden fees in the form of management charges, transaction fees, or account maintenance costs. These fees might seem small as percentages but can significantly impact long-term investment returns when compounded over time.

Understanding utility and service provider fees

Cable, internet, and satellite TV providers often include numerous additional charges beyond their advertised rates. These might include broadcast TV fees, regional sports fees, equipment rental charges, or various administrative costs. Some providers even charge fees for paying bills or receiving paper statements.

Mobile phone carriers frequently add various surcharges to monthly bills, including administrative fees, regulatory charges, and connection fees. These additional costs can make the actual monthly payment significantly higher than the advertised plan price. Some carriers also charge early termination fees or activation fees.

Utility companies sometimes include fees for infrastructure maintenance, environmental compliance, or fuel cost adjustments. While some of these charges reflect real costs, they’re often not included in the advertised rates, making it difficult for consumers to compare prices between different providers accurately.

Home service providers, such as lawn care companies or cleaning services, might add equipment fees, supply charges, or fuel surcharges to their base rates. These additional costs can substantially increase the final bill, even when they’re not mentioned during the initial service quote.

Medical and healthcare billing surprises

Healthcare providers often add facility fees or supply charges that may not be fully covered by insurance. These fees can appear on bills from routine doctor visits to emergency care services. Some medical offices now charge additional fees for administrative tasks like completing forms or providing copies of medical records.

Dental offices might include separate charges for protective equipment, sterilization procedures, or x-ray fees beyond the basic service costs. These additional expenses may not be covered by dental insurance plans, leading to unexpected out-of-pocket costs for patients. Some practices also add technology fees for digital record-keeping or imaging services.

Laboratory tests often come with multiple separate charges, including processing fees, handling fees, or rush service charges. These additional costs might not be apparent when the tests are ordered and can vary significantly between different laboratories or testing facilities.

Prescription medications may include dispensing fees, consultation fees, or compound preparation charges beyond the basic cost of the medication. These fees can vary between pharmacies and might not be fully covered by insurance plans, potentially leading to significant differences in out-of-pocket costs.

Event tickets and entertainment charges

Ticket sellers for concerts, sports events, and other entertainment venues often add numerous fees to the base ticket price. These can include service charges, facility fees, processing fees, and delivery charges. Sometimes these additional costs can increase the final price by 20% or more above the advertised ticket price.

Online ticket platforms frequently charge convenience fees or processing charges for each ticket purchased. Some venues add facility maintenance fees or restoration charges to help cover building upkeep costs. Many events also include separate parking fees that might not be disclosed during the ticket purchase.

Mobile ticketing has introduced new technology fees or digital delivery charges, even though these methods often reduce costs for vendors compared to traditional paper tickets. Some venues charge additional fees for ticket transfers or resales, even when using their official platforms.

Premium experiences or VIP packages might include various undisclosed fees beyond the upgraded ticket price. These could include meet-and-greet charges, merchandise package fees, or priority access surcharges that significantly increase the total cost of the experience.

Legal protection against hidden fees

Several states have enacted laws to protect consumers from hidden fees and require businesses to disclose all mandatory charges upfront. California’s Honest Pricing Law, which took effect in July 2024, requires businesses to include all mandatory fees in their advertised prices, except for government taxes and reasonable shipping costs.

New York and Minnesota have implemented similar regulations to combat “drip pricing” practices. These laws require businesses to clearly disclose all mandatory fees and surcharges in their initial price advertisements. Violations can result in enforcement actions by state attorneys general offices.

Consumers who encounter hidden fees may have legal recourse through class action lawsuits or complaints to regulatory agencies. While individual fees might be relatively small, collective legal action can help compensate multiple consumers and encourage businesses to comply with applicable laws.

The Federal Trade Commission and Consumer Financial Protection Bureau also provide oversight and enforcement against deceptive pricing practices. These agencies can investigate complaints and take action against businesses that engage in unfair or deceptive fee practices.

How to dispute and avoid hidden charges

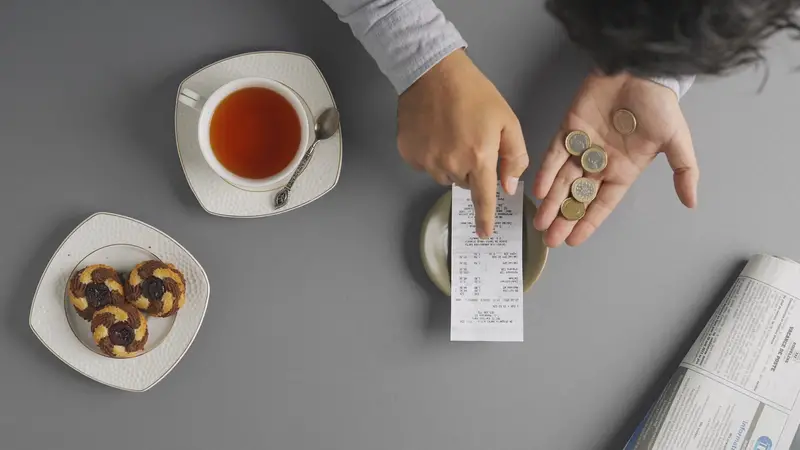

One effective strategy for avoiding hidden fees is to always review bills and receipts carefully before paying. Question any unexpected charges and ask for a detailed explanation of each fee. Many businesses will remove or reduce fees if customers express concerns, especially if they want to maintain customer loyalty.

Consider using cash when possible, as this can help avoid credit card processing fees and other electronic payment surcharges. Some businesses offer cash discounts that can result in significant savings. When using credit cards, choose ones that offer protection against hidden fees or provide rewards that can offset additional charges.

Research prices and fees before making purchases or reservations. Compare total costs, including all fees, between different providers. Many businesses now offer price matching or competitive rates when presented with lower prices from competitors, including fee structures.

Keep detailed records of all transactions and maintain copies of advertisements or promotions that show promised prices. This documentation can be valuable when disputing unexpected charges or seeking refunds for undisclosed fees.

As hidden fees continue to proliferate across industries, staying informed and vigilant remains crucial for protecting your financial interests. While some fees may be unavoidable, understanding common charges and knowing your rights can help minimize their impact on your budget. Remember to review all bills carefully, question unexpected charges, and maintain records of your transactions. With increasing regulatory attention and consumer awareness, businesses may eventually shift toward more transparent pricing practices, but until then, careful scrutiny of receipts remains your best defense against sneaky charges.