Country music might seem like a guaranteed path to financial security, but some of the biggest names in the industry have faced shocking financial ruin. From million-dollar mansions to bankruptcy court, these stars learned the hard way that fame doesn’t always equal fortune. Bad investments, poor management, and extravagant lifestyles have left even Grammy winners counting pennies instead of platinum records.

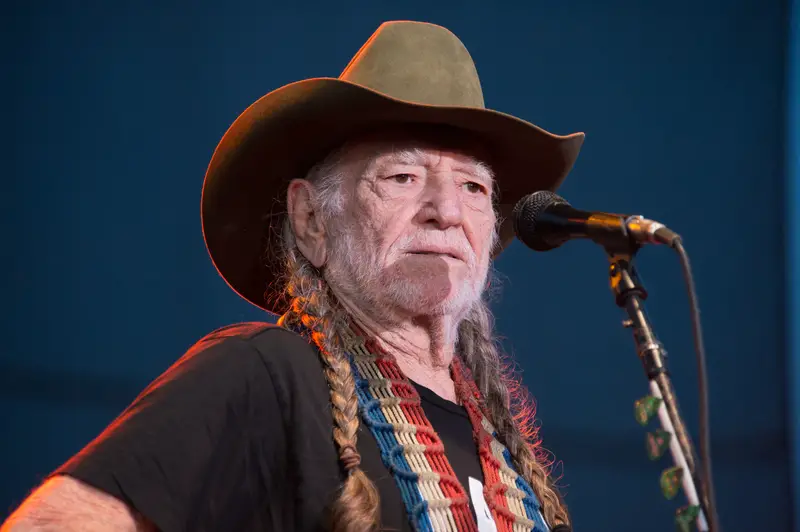

Willie Nelson’s tax nightmare nearly ended his career

Willie Nelson’s financial troubles in the early 1990s became legendary in country music circles. The IRS seized virtually everything he owned, from his recording equipment to personal belongings, auctioning them off to pay his massive tax debt. His accountants had made terrible investment decisions and failed to pay proper taxes on his earnings for years, leaving Nelson owing millions to the government when the bill finally came due.

Rather than give up, Nelson took an unusual approach to solving his money problems. He recorded an album called “The IRS Tapes: Who’ll Buy My Memories?” with the specific purpose of generating revenue to pay off his debts. Nelson openly admitted this wasn’t his most artistic work, but it served its purpose. The country legend eventually paid off his obligations and rebuilt his career, proving that sometimes the best way out of a hole is to keep digging with determination.

MC Hammer’s mansion cost half a million monthly

MC Hammer’s rise to fame with “U Can’t Touch This” in 1990 led to astronomical success, with his album selling ten million copies worldwide. Unfortunately, his spending matched his earnings in the worst possible way. Hammer purchased a $30 million mansion and hired a full staff to maintain it, creating monthly expenses that reached an incredible half million dollars. His payroll alone included dozens of employees, from dancers to security guards to personal assistants.

When his popularity faded as quickly as it had arrived, those massive monthly bills didn’t disappear with his record sales. By 1996, Hammer was $13.7 million in debt with only $9.6 million in assets, forcing him to declare bankruptcy. Among his outstanding debts were $100,000 to the IRS, half a million in legal fees, and another $500,000 borrowed from Dallas Cowboys player Deion Sanders. The rapper’s story became a cautionary tale about matching lifestyle to sustainable income rather than peak earnings.

Toni Braxton filed bankruptcy twice despite massive sales

Toni Braxton sold 25 million albums worldwide, yet she still found herself in bankruptcy court not once, but twice. Her first bankruptcy filing in 1998 came after she accumulated a $20,000 American Express bill and monthly expenses exceeding $43,000. Despite her “Un-break My Heart” success, poor financial management and excessive spending drained her accounts faster than royalty checks could fill them. She managed to recover with her 2000 album “The Heat” and seemed to be back on solid financial ground.

Braxton’s second financial disaster struck in 2010, proving that even experienced artists can stumble twice. Her successful Las Vegas residency at the Flamingo Hotel was extended through 2008, but health problems forced her to cancel the remaining shows. As a heart disease sufferer, she made the wise choice to prioritize her health over her contract, but the cancellation created tens of millions in debt obligations. The singer filed for bankruptcy again in October 2010, showing how quickly circumstances can change even for established performers.

Ted Nugent lost everything to bad business ventures

Ted Nugent’s 1970s hits like “Cat Scratch Fever” and “Stranglehold” made him one of America’s highest-grossing concert attractions. Unlike many rock stars, Nugent never touched drugs or alcohol, preferring hunting and outdoor activities. His clean lifestyle should have given him better financial judgment, but unfortunately, he trusted the wrong people with his money. His managers convinced him to invest his considerable wealth in ventures that seemed promising but turned out to be financial disasters.

The investments that destroyed Nugent’s finances included Clydesdale horses and mink farms, neither of which generated the returns his advisors promised. These weren’t small side investments either – they represented significant portions of his concert earnings from his peak years. By 1980, the rock guitarist was forced to declare bankruptcy, despite never having the addiction problems that derailed many of his contemporaries. He recovered before the decade ended and continues performing today, having learned to be more selective about his financial advisors.

Marvin Gaye’s divorce settlement used future album royalties

Marvin Gaye created some of the most beloved soul music ever recorded, including “I Heard It Through the Grapevine” and the entire “What’s Going On” album. However, his personal life was far messier than his smooth musical style suggested. His marriage to Anna Gordy fell apart after he had an affair and fathered two children with another woman. When Gordy filed for divorce, Gaye discovered that despite his impressive record sales, his bank account was nearly empty due to extravagant spending on cars, real estate, and cocaine.

Unable to pay traditional alimony and child support, Gaye’s ex-wife agreed to an unusual arrangement where she would receive $600,000 in royalties from his next album instead of cash payments. This creative solution led to one of music’s most bitter albums, “Here, My Dear,” released in 1978. The soul legend filed for bankruptcy in 1976, and the album meant to solve his financial problems received terrible reviews and sold poorly, adding insult to his financial injury.

Meat Loaf’s voice problems killed his follow-up success

Meat Loaf’s 1977 album “Bat Out of Hell” ranks among the highest-selling albums of all time, sharing company with AC/DC’s “Back in Black” and Pink Floyd’s “Dark Side of the Moon.” Songs like “Two Out of Three Ain’t Bad” and “Paradise by the Dashboard Light” made him an unlikely but massive star. However, while working on his follow-up album, he developed serious voice problems that prevented him from completing the recording for several years, during which time his popularity faded significantly.

By the time Meat Loaf finally released “Dead Ringer” in 1981, the music landscape had changed and his moment had passed. The album sold only a fraction of what “Bat Out of Hell” achieved, and by 1983 he was $1.6 million in debt and forced to declare bankruptcy. Fortunately, his story has a happy ending – in 1993, “Bat Out of Hell II: Back Into Hell” went to number one in three countries. The single “I’d Do Anything for Love (But I Won’t Do That)” reached number one in 28 countries, proving that comeback stories are possible in the music industry.

David Crosby’s drug addiction destroyed his finances

David Crosby helped found the Byrds in the 1960s and later became one-third of the hugely successful group Crosby, Stills and Nash, sometimes joined by Neil Young. The soft rock group dominated their era with massive album sales and sold-out concerts worldwide. When the group eventually broke up, each member pursued solo careers, but Crosby’s path led him into serious trouble with cocaine and heroin addiction that consumed both his creativity and his money throughout the 1970s and 1980s.

By 1985, Crosby had hit rock bottom both personally and financially. His behavior spiraled completely out of control, culminating in arrests for hit-and-run driving, possession of a concealed weapon, and drug possession. None of this helped his record sales, which had been declining as his addiction worsened. The musician filed for bankruptcy as his once-thriving career collapsed under the weight of his personal problems and legal troubles.

Dee Snider from Twisted Sister lost it all after metal’s decline

The 1980s represented heavy metal’s golden age, and Twisted Sister stood among the genre’s most successful bands with hits like “We’re Not Gonna Take It.” Lead singer Dee Snider became a celebrity beyond music, known for his distinctive appearance, powerful vocals, and his memorable congressional testimony alongside John Denver during the 1985 Parents’ Music Resource Center hearings. His band sold millions of albums and packed arenas worldwide during metal’s peak popularity years.

Like many heavy metal acts, Twisted Sister’s success was tied to a specific musical trend that eventually faded. When public taste shifted away from their style of rock music in the late 1980s, album sales plummeted and concert attendance dropped dramatically. The band’s expenses, which had been manageable during their peak earning years, suddenly became unsustainable burdens. Snider and his bandmates found themselves facing financial ruin as quickly as they had found fame, demonstrating how volatile the music business can be for genre-specific acts.

Poor financial advice destroyed multiple country careers

Many country stars who went bankrupt share a common thread: they trusted financial advisors who either gave terrible advice or outright stole from them. These musicians focused on their craft while leaving money management to supposed professionals who made disastrous investment decisions. Real estate schemes, failed business ventures, and risky stock market plays drained accounts that should have provided lifetime security for these artists and their families.

The pattern repeats itself across different eras and musical styles – successful artists hand over their earnings to managers, accountants, and investment advisors who promise to multiply their wealth but instead lose it all. Some of these financial disasters resulted from genuine incompetence, while others involved deliberate fraud that left stars both broke and betrayed. The music industry has seen countless examples of this tragic scenario, where talent and hard work get wiped out by financial mismanagement beyond the artist’s control.

These stories remind us that financial success in entertainment requires more than just talent and hit records. Smart money management, trustworthy advisors, and living within sustainable means matter just as much as platinum albums and sold-out tours. Even the biggest stars can find themselves flat broke if they don’t pay attention to where their money goes.